Buyer demand ticks higher as consumer confidence improves

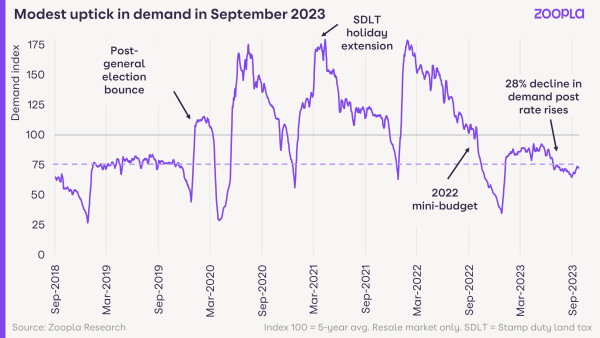

Our House Price Index for September 2023 shows a rise in buyer demand after the summer lull, with enquiries to estate agents up 12% since the August Bank Holiday weekend.

This measure of buyer demand is now in line with 2019, although 33% lower than a year ago.

The uptick in enquiries is partly seasonal, as we usually see people return to their home-moving goals when the summer holidays end. But it also reflects that consumer confidence is at a two-year high, boosted by the prospect of lower mortgage rates on the horizon.

Buyer demand has improved in all parts of the country, most noticeably in the South of England which has had the fewest enquiries throughout 2023.

Our latest House Price Index has also recorded more agreed sales this month, matching the levels of 2019. This is supported by a boost in the number of homes for sale to pre-pandemic levels, giving much greater choice for people buying a home.

No change in property preferences as buyers unwilling to compromise

Mortgage rates remain over 5%, reducing household buying power by 20% compared to early 2022. Despite this knock to affordability, buyers are not compromising on the type of home they’re looking for.

The share of buyer demand by property type and size is virtually the same as a year ago. There’s also been no change to the price bands buyers are interested in.

People are overwhelmingly holding out for the sort of home they want, apart from some small regional variations such as slightly greater demand for flats in London.

It seems that people would rather wait for a fall in house prices or mortgage rates than risk moving to the wrong property. This is why our House Price Index suggests the number of agreed sales this year will be 20% lower than last year, and mortgaged sales 28% lower.

It’s a rational approach - buying a home is a big and expensive life event. Younger buyers are taking longer mortgages to boost their buyer power, so it makes sense to buy a property you’ll be happy with for a decade or longer.

House prices on track to be 3% lower over the course of 2023

Our House Price Index has recorded a 0.5% fall in house prices over the last year. This is the first annual decline for over a decade, since June 2012.

But the house price falls we’ve seen over the last year have been modest, despite the large hit to buying power by mortgage rates.

While many households have delayed moving, the housing market has been somewhat protected by more fixed-rate loans, tougher affordability testing and a robust jobs market. These factors mean there are fewer forced sellers in the market.

The house price falls are concentrated in the South of England, where higher mortgage rates have a bigger impact on buyer affordability.

In Scotland, on the other hand, house prices have risen 1.6% in the last year. House prices are 40% below the national average here, so many buyers can afford higher mortgage rates.

We expect our House Price Index to record small month-on-month falls in house prices throughout autumn. We’ll end the year with house prices 2% to 3% lower than the start of the year on average.

This would leave house prices 17% higher than at the start of 2020, just before the pandemic.

The small house price falls so far are not enough to boost affordability and support a recovery in property sale volumes - even if mortgage rates dip below 5%. We expect further modest house price falls into the start of 2024.

Are house prices falling in September 2023?

Mortgage rates on track to fall below 5%

Lower mortgage rates are the key way to improve affordability and buying power in the next 12-18 months - more so than falling house prices.

The latest inflation news was better than predicted and the subsequent pause in Bank Rate rises has improved the outlook for mortgage borrowing costs in the coming months.

What’s more, the cost of finance to banks for fixed-rate lending has fallen in the last month. This means banks have room to reduce mortgage rates.

However, this underlying cost is still almost one percentage point higher than in spring 2023. The rate for a 5-year fixed mortgage at a 75% loan-to-value (LTV) fell to 4.2% in spring, which boosted buyer demand and the number of agreed sales.

Across the UK’s biggest lenders, the average rate for this 5-year, 75% LTV mortgage is now 5.1%. This shows the difference that still remains in mortgage rates before we see a boost in the housing market.

We expect mortgage rates to continue to fall slowly in the coming weeks to below 5%. However, there is still uncertainty about what’s happening with inflation and how quickly the current 6.7% inflation rate can fall to the Bank of England’s 2% target.

Our view has always been that mortgage rates over 5% mean fewer sales and year-on-year house price falls. The closer mortgage rates get to 4%, the more buyers will come back into the market, supporting sales and pricing.

What’s happening with mortgage rates?

Average 4.2% discount knocks £12,125 off original asking price

The housing market remains a buyers’ market, with 80% more homes for sale than in September 2021.

This gives buyers options to negotiate with sellers, and has resulted in an increase in discounts to asking prices over the summer.

The average discount is now 4.2% or £12,125 off the original asking price. This is the biggest average discount since March 2019, although still below the highs of late 2018.

Discounts to asking prices are greatest on properties for sale in London and the South East, where sellers are knocking 4.8% off their asking price on average. The rest of the UK collectively averages a 2.8% discount.

What’s going to happen next in the housing market?

The housing market continues to adjust to higher borrowing costs. Mortgage rates have more than doubled since 2021 which, together with increased costs of living, represents a big adjustment for home buyers and the wider housing market.

The impact on house prices has been small compared to how much buyer power has been hit. Forbearance by lenders, tough mortgage regulations and the strong labour market have moderated the stress. Previous cycles of similar economic conditions saw much larger house price falls.

The biggest impact so far has been on the number of sales in the market. These are on track to reach 1 million in 2023, which will be a fifth lower than in 2022.

This number is tracking above 2019 levels, despite lower buyer demand. It’s evidence that there are still buyers who are serious about moving, though they’re fewer in number.

Some buyers are returning to the housing market this autumn having delayed their move while the Bank Rate moved higher. Many others continue to wait on the outlook for mortgage rates as they maintain their requirements in their next property.

The quicker mortgage rates move towards 4.5% or lower (for a 5-year, 75% LTV fixed rate), the sooner buyers will return to the housing market. This seems more likely to happen in 2024 than in 2023.

Lower mortgage rates do not mean house prices will start to rise but - importantly - they support sales volumes and market liquidity. House prices need to fall more in the most unaffordable parts of the country to boost buyer power and open up the housing market to more people.

Thinking of selling?

Get the ball rolling with an in-person valuation of your home. It’s free and there’s no obligation to sell if you change your mind.