The average house price in the UK is £264,900 as of May 2024 (published in June 2024).

Property prices are now at 0% inflation compared to a year ago. However, the average UK house price is set to rise by 1.5% by the end of the year.

Key figures

Average house price in March 2024 | Average house price in April 2024 | Average house price in May 2024 | Year-on-year change (£) | Year-on-year change (%) | |

All property | £264,300 | £264,700 | £264,900 | +£110 | 0.0% |

Detached houses | £445,800 | £446,400 | £447,500 | -£2,290 | -0.5% |

Flats | £190,400 | £190,700 | £191,100 | -£2,030 | -1.10% |

Semi-detached houses | £269,100 | £269,300 | £270,100 | +£1,950 | +0.7% |

Terraced houses | £233,700 | £232,700 | £233,600 | +£1,910 | +0.8% |

The graph shows how the UK’s average house price has changed in the last 10 years.

Home buyers and sellers shrug off election

The recent pick up in sales market momentum has continued over June, albeit at a slightly slower pace than the previous 2–3 months. New sales agreed are still running 8% higher than a year ago, and other key measures of market activity are also higher year-on-year.

However, there are signs that market activity is starting to slow as we approach the quieter summer period. Buyers and sellers who were at the start of the home-buying process when the election was called are more likely to have delayed their buying decisions until after the election. And this is adding to the slowdown in activity.

Sales agreed are down slightly month-on-month across all regions, led by the North East (-6%) and West Midlands (-5%). The overall stock of homes for sale continues to grow across all regions, albeit at a slower rate than recorded over recent months. There are still almost a fifth more homes for sale than a year ago.

House price inflation is static, and is still negative in the South

Improving sales volumes over the first half of 2024 has led to a levelling in average house prices which is reflected in our house price index. All regions and countries of the UK have registered an increase in house prices on a month-on-month basis since January.

The annual rate of UK house price inflation is now static at 0% in May 2024, up from a low of -1.3% in November 2023, and +1.6% a year ago. House prices continue to register annual price falls across southern England at a slowing rate. But prices continue to increase across the rest of the UK by up to 3.3% in Northern Ireland.

We see no evidence that price rises will pick up speed in the coming months. However, UK house prices are on track to be 1.5% higher at the end of 2024.

75% of this year’s sales are completed or in progress

The 4–5 months between a sale being agreed and then completed means we have a good view into the sales pipeline for 2024. Our data shows the market is still on track for 1.1m sales this year.

Three quarters of these 1.1m expected sales have either been completed, or they’ve been agreed and are working their way toward completion. There are still over 250,000 sales yet to be agreed that we expect to complete by the end of 2024.

The 1.1m sales figure is 10% higher than 2023, but still below the 20-year average. It is positive that sales are rising despite higher borrowing costs and it shows a more realistic view from sellers, as well as a renewed, cautious confidence amongst buyers.

The sales market has proved resilient

The housing market has been very resilient over the last year given the rise in mortgage rates. These averaged below 2% in late 2021 and stand at 4.7% today, spiking well over 5% in October 2022 and again over the summer of 2023.

Higher borrowing costs have reduced the buying power of new buyers. Rather than sizable price falls, the main impact has been a sharp decline in the number of sales - 23% lower over 2023.

House prices haven’t fallen as there have been few forced sellers. Unemployment has stayed low by historic standards, and there are a relatively small number of people struggling to pay their mortgage - despite wider cost of living pressures.

House prices still look expensive on various measures of affordability. We expect house price inflation to remain muted, and likely to rise more slowly than household incomes over the next 1–2 years.

Housing remains overvalued but the trend is improving

One way we track affordability is to measure the extent to which actual house prices are higher or lower than an “affordable house price”. This is calculated from household incomes and mortgage rates.

The recent jump in mortgage rates led to house prices being overvalued by 13% at the end of 2023. This is less severe than in the run up to 2007 (the global financial crisis) and during the “house price bubble” of the late 1980s house. Double digit price falls followed both these periods of overvaluation. Price falls have been smaller more recently as the overvaluation was more modest and sales volumes have taken the hit.

Faster wage growth over the last 3 years has boosted household disposable incomes and helped offset some of the impact of higher mortgage rates. Mortgaged buyers have also been taking longer term mortgages to eke out that extra 5%+ of additional buying power.

We estimate that house prices were 8% overvalued at the end of March 2024, but by the end of the year this overvaluation will disappear. This assumes house prices rise 1.5% and mortgage rates remain at 4.5%.

Interest rates hold the key

Looking ahead, the short-term outlook for the sales market will depend on the outlook for mortgage rates, which is also dependent on the outlook for interest rates. Any reductions in the base rate over the summer and into the autumn will deliver a boost to market sentiment and sales activity, even though the impact on fixed rate mortgages will likely be more muted.

Based on city forecasts for base rates, mortgage rates are expected to remain in the 4-4.5% range. This is sufficient to support sales volumes and low, single-digit levels of house price growth. House prices in the south of England are expected to continue to under-perform the UK average as they realign with incomes. (Income growth is the key to supporting sales and demand into 2025.)

House Price Index - country, region and city summary

Download the House Price Index June 2024

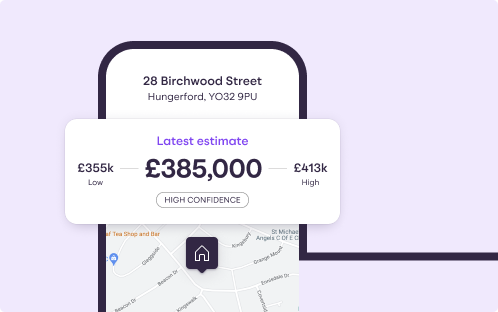

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

Previous House Price Index reports

See more stories from our House Price Index

About our House Price Index

The Zoopla House Price Index (HPI) is a repeat sales-based price index, using sold prices, mortgage valuations and data for recently agreed sales. The index uses more input data than any other and is designed to accurately track the change in pricing for UK housing. It’s a revisionary index and non-seasonally adjusted.

The HPI for May 2024 uses the most recent full data available up to April 2024. We revise previous data where needed to ensure the most accurate representation of the market at any given time.