Housing market confidence hits low point at end of 2010

13th January 2011

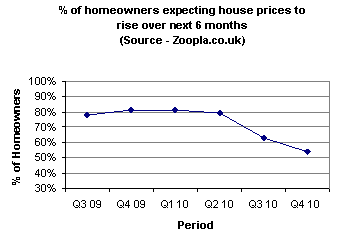

- 54% of homeowners expect house prices to rise, down from 81% one year ago

- 1 in 3 expect property prices to fall in 1H 2011, up from 1 in 4 three months ago

- Fewer owners plan doing any home improvements and will spend less in 2011

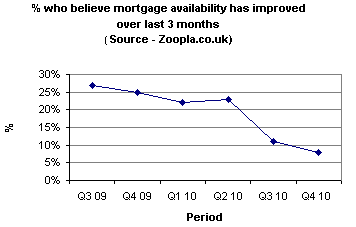

- 92% see mortgage financing as no easier to obtain now than 3 months ago

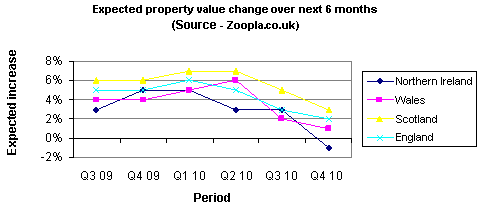

- Scottish most upbeat over housing outlook for 2011, N Irish far less optimistic

Homeowner confidence in the property market outlook fell to its lowest level in more than two years in December, amid concerns over the government’s austerity measures and the availability of mortgage finance. According to the latest Zoopla.co.uk Housing Market Sentiment Survey, only 54% of homeowners surveyed expected house prices to rise over the coming six months, down sharply from 63% three months ago and 81% a year ago.

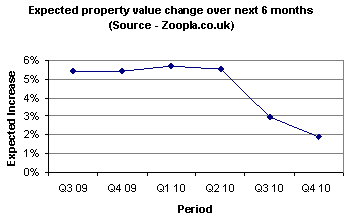

According to the survey of 5,287 UK homeowners by leading property search and information website Zoopla.co.uk, those surveyed now expect average house prices to rise by only 1.9% over the next six months, down from a predicted 3% rise three months ago and reflecting the drop in confidence. And the number of homeowners who expect property prices to fall over the first half of 2011 now stands at 1 in 3 (33%) up from 1 in 4 (25%) only three months ago.

UK homeowners, however, curiously remain more confident about the prospects for the value of their own homes compared to those of their neighbours, with those surveyed expecting average growth in property values in their local area of only 1.9% over the next six months versus 2.5% for their own homes.

The survey also highlighted that fewer homeowners plan to carry out home improvements over the next six months, with only 37% of respondents stating an intention to do any works, down from 42% three months ago and 48% at the start of 2010. And the percentage of homeowners who plan to spend at least as much this year as they did last year on improving their properties now stands at only 68%, down from 77% at the beginning of 2010.

And the survey results show just how severely the lack of access to mortgage finance is impacting the health of the property market and confidence in it. Only 8% of those surveyed believe that it is now easier to get financing than it was three months ago, with more than 9 out of 10 seeing no improvement in the availability of financing over the past three months.

Confidence in Scotland appears higher than the rest of the UK, with 63% of Scots expecting house prices in their area to rise over the next six months, although this is still down from 71% three months ago. England is some way behind at 54% whilst less than half of homeowners in both Wales (49%) and N Ireland (42%) expect house prices to rise in the next six months.

However, the new year appears to have got off to a solid start indicating that confidence may be increasing since the end of last year. Zoopla.co.uk is reporting record levels of traffic, searches and leads in early January with visitor traffic up over the first few days of the new year up by an impressive 102% compared to the same period last year.

Nicholas Leeming of Zoopla.co.uk, commented: "The uncertainty around the impact on the overall economy in 2011 of the austerity measures and the continuing drought in mortgage finance availability created a toxic combination for housing market confidence in late 2010. There is every reason to expect confidence to grow as this year progresses providing the economic outlook doesn't worsen and banks start to loosen their lending criteria."

- Ends -

For further information, please contact PR Team on pr@zoopla.co.uk or +44 (0)20 3873 8770.

About Zoopla

Hello. We're Zoopla. A property website and app.

We know you're not just looking for a place to live. You're looking for a home.

Yeah, we've got over a million properties for you to browse.

Tools that let you filter them in all kinds of clever ways.

And reliable house price estimates, so you can be sure you aren't paying over the odds.

But we know you're looking for more than that.

Because that first flat won't just be a 'great investment opportunity'.

It'll be the feeling of starting out on your own.

That extra bedroom won't just mean another £20K on the re-sale price, it'll mean having your sister over to stay.

And that bungalow won't just be a way to release some equity, it will be a chance to spend more time with the grandkids.

We know that searching for a home is about more than just checking its price, location and features (important as all those things are).

What really matters is how it makes you feel.

We know what a home is really worth.

So let us help you find yours.

Zoopla is part of Zoopla Limited which was founded in 2007.

Zoopla Limited, The Cooperage, 5 Copper Row, London, SE1 2LH

Registered in England and Wales with Company No. 06074771

VAT Registration number: 191 2231 33

Data Protection number: Z9972266