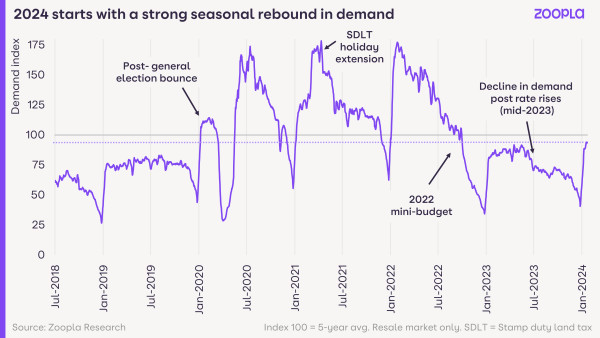

2024 has begun well for the housing market, with buyer demand up 12% year-on-year and the number of sales agreed climbing 13%.

Last year’s rising mortgage rates saw many buyers delay moving, but with rates dropping below 5% in January, more began returning to the market.

Demand is definitely up, but it’s still 13% below the five-year average (including the pandemic ‘boom years’ of 2021 and 2022).

Confidence improves for sellers

The number of sales agreed is up year-on-year across all countries and regions.

Yorkshire and the Humber is leading the way (+19%), followed by the West Midlands (+17%).

Our Executive Director of Research, Richard Donnell, says: ‘This shows that buyers and sellers are becoming more aligned on pricing and that sellers, many of whom are also buyers, are feeling more confident.

‘Overall supply is up 22% on last year, with the average estate agent having 28 homes for sale, boosting choice for buyers and keeping prices in check.’

See what local experts think your home is worth

If you're getting ready to sell or just super curious, we recommend getting a free, in-person valuation from a local estate agent.

What is happening with house prices right now?

House price falls are now starting to slow as more sales are agreed.

In October, prices fell by -1.4% year-on-year, however in December, this slowed to -0.8% year-on-year.

The greatest falls are now being seen in the East of England (-2.5% YoY) and the South West (-2.2% YoY). Conversely, Northern Ireland saw prices grow by 3.2% year-on-year in 2023.

However, we believe higher mortgage rates will continue to affect house prices in 2024.

It remains a buyers’ market

‘The rebound in activity in the first weeks of 2024 is positive news but it’s important not to over-interpret what this might mean for the rest of the year,’ says Donnell.

At the beginning of 2023, mortgage rates fell to 4.2% and we saw an uplift in sales with modest house price falls.

‘We expect this to continue in 2024, with lower mortgage rates supporting sales volumes, rather than having a positive impact on prices,’ he adds.

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

House prices are unlikely to rise in 2024

More homes for sale means more choice for buyers, especially when it comes to larger family homes.

But half of mortgagees are still yet to refinance onto higher rates.

‘This is important,’ says Donnell. ‘As many would-be buyers are upsizers who will need a larger mortgage to move to a bigger home.

‘Higher repayments will ensure buyers remain price sensitive and focused on value-for-money.’

Our data shows sellers are continuing to cut asking prices to make sure homes attract buyer interest.

In fact, more than 1 in 5 are having to accept more than 10% off the asking price to agree a sale, rising to 1 in 4 across London and the South East.

‘Sellers must continue to price realistically if they are serious about moving in 2024,’ says Donnell.

‘Improved market conditions will boost the chances of a sale, but sellers shouldn't expect to list at a higher asking price.’

Is the London market starting to bounce back?

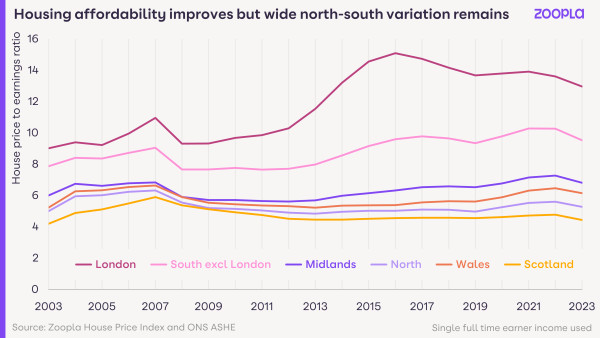

The capital, long the most expensive part of the country to buy a home, has suffered in terms of house price growth in recent years.

In 2016, homes reached ‘peak unaffordability’ as buyers were forced to fork out over 15 times their annual salaries to buy a home.

House prices simply couldn’t keep rising as buyers could no longer afford the mortgages needed to secure them. The London market hit the ceiling.

Since 2016, prices in the capital have grown a mere 13%: that’s way less than the 34% growth seen across the rest of the UK - and the 50% seen in Wales.

But it’s now enjoying a bit of a moment: in the first weeks of 2024, London and the East of England have led the rebound in new buyer demand.

‘This could reflect a turn of fortunes for the London housing market,’ says Donnell.

Ready to find your dream home?

Search more than half a million properties for sale, from brand new homes to period homes.

Why haven’t prices risen in London since 2016?

Aside from the capital being the most expensive place to buy a home in the UK, there are several other reasons why prices have stalled here:

tax changes, preventing investors and overseas buyers from snapping up properties

the Brexit vote, which hit jobs growth

the pandemic, which closed cities to travel and changed working patterns

higher mortgage rates, which hit the most expensive housing markets hardest

All of this means London housing is now at its most affordable level since 2014, as wages have risen while prices have stalled.

The average house price in the capital now sits at 13 times the average annual salary.

‘Slowly improving housing affordability in London is positive news,’ says Donnell. ‘But home buyers still face a sizable affordability challenge with mortgage rates doubling since 2021.

‘We expect market conditions in London to continue to improve over 2024, with earnings rising faster than house prices.

‘This will continue to improve affordability and support levels of housing sales, rather than boost house prices.’